Adam Owen, learning and curriculum director at NextGen Planners, talks about working with the CISI and turning the financial planning profession on its head

by Bethan Rees

How to achieve CFP™ certification

At the heart of the financial planning network NextGen Planners is "the idea of collaboration", Adam Owen says, which is reflected in its work with the CISI. By bringing people together and being inclusive, he says, "we can achieve so much as a profession". Since 1 July 2021, NextGen Planners has been putting this concept into practice by offering free support for its members sitting the CISI level 6 Certificate in Advanced Financial Planning in September.

The support runs for 60 days and includes daily content comprising videos, written modules, revision checklists, mentor interviews, knowledge check quizzes and group tutorials.

Turning the profession on its head

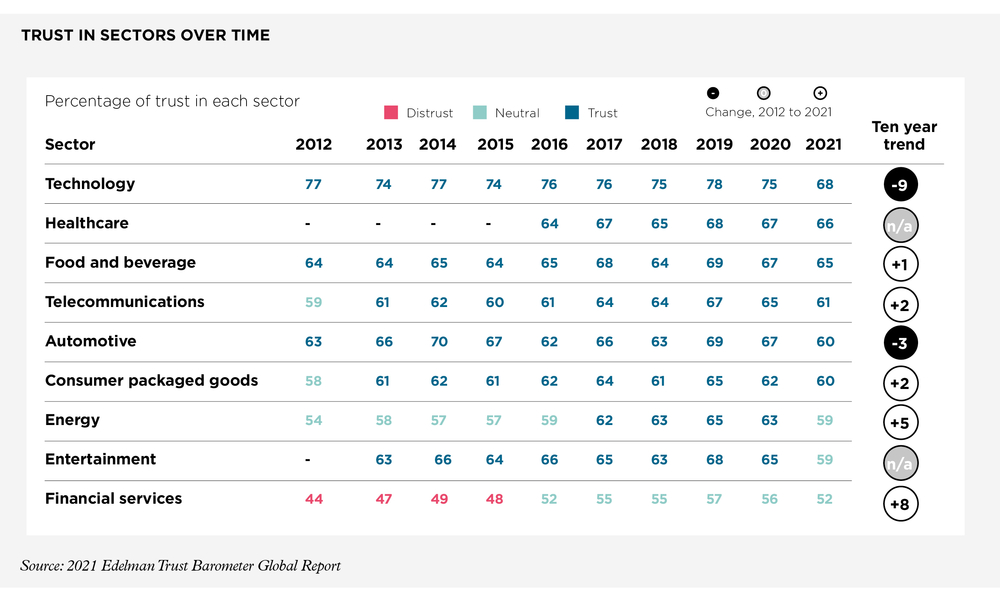

The financial services sector is being challenged by a lack of public trust, says Adam. The Edelman trust barometer 2021 shows that public trust declined from 57% to 52% from 2019 to 2021. However, looking at a longer time scale, trust in financial services globally has been slowly rising over a ten-year period, from 44% in 2012. These overall figures, though, still put financial services bottom of the list of nine sectors.

"There is a lot of work to be done to improve public trust in financial services, but this has to be our biggest focus as without trust, our profession will simply end," he says.

NextGen Planners wants to reduce inequalities within and among the profession, and Adam believes that to do this, we need to "redesign systems and processes". So, for the NextGen Planners Conference 2021, the organisation turned "the normal process on its head". They invested their budget in designing a speaker training programme that was free and open to volunteers, to expand its existing pool of established speakers. NextGen Planners also set the goal of gender parity, selecting 50 women and 50 men from the initial volunteers. "We didn’t need to choose established speakers as we knew they would be going through a training programme to prepare them for the stage. We just needed to choose people with great ideas and compelling reasons to want to be on stage," he explains. As a result, the conference, on 25 June 2021, saw a diverse range of speakers, including a 21-year-old and a 62-year-old, both of whom were speaking in public for the first time.

This widening participation initiative has enabled Adam to experience being part of a global financial planning community. "It's remarkable how similar we all are," he says. "The financial planners that I speak to every day in Malaysia, Ghana, Australia, South Africa, the US and so many more countries all put their clients first. Being part of a global financial planning community adds context to what we do here in the UK and boosts innovation."

Bridging the succession gap

NextGen Planners has added the Financial Adviser Network (FAM) to its community this year. One of its missions is to support second careerists looking to develop careers in financial planning.

"We have a succession gap in our profession and need to recruit many more people into both financial planning roles and also leadership roles," Adam says. He explains that second careerists "bring transferable skills and experience that can enhance the operational side of a financial planning practice".

NextGen will provide the infrastructure for the FAM network to grow, and contribute ideas to help bring the FAM community together "so that a new generation of aspiring financial planners can collaborate to achieve their career goals".

When asked to give some advice to those wanting to enter the profession, Adam says to "focus on understanding the value that you bring … and make sure that every day is a learning day".

Support in the pathway to being a CFP™ professional

To become a CFP professional, one of the exams candidates must take is the CISI's level 6 Certificate in Advanced Financial Planning. Adam says NextGen Planners wanted to create a pathway for its members to help them achieve this, so designed the 60-day challenge, in collaboration with the CISI. This programme aims to encourage people to take the first step on the way to achieving CFP certification and is free to NextGen Planners members. The programme will run ahead of each cycle of the CISI level 6 Certificate in Advanced Financial Planning. The exam after September 2021 will be in March 2022.

"The CISI has been integral in the development of the programme and provided the building blocks for our content. The programme follows the syllabus closely but focuses on the key elements to help candidates study as efficiently as possible," says Adam.

NextGen Planners will also be offering support for the second component of the CFP certification: the level 7 case study, which, in combination with the level 6 certificate, leads to the level 7 Diploma in Advanced Financial Planning. Following this, the candidate can apply to the CISI to become a CFP professional. Adam says NextGen is expecting to launch this support before the end of 2021. It is also "looking at options for the CISI level 4 qualifications".

For more information on how to join NextGen Planners' 60-day challenge, visit https://mailchi.mp/nextgenplanners/60-day-cfp-challenge.